Personal Banking - checking, savings, mortgage, loans and more

Log in to Online Banking

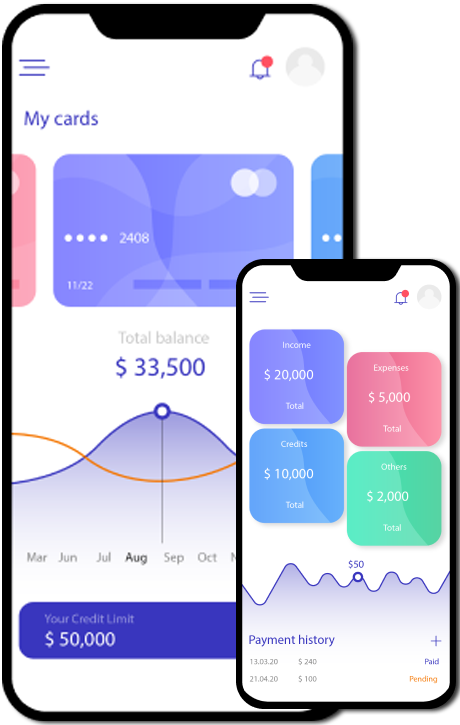

Monitor your accounts, make payments, move money and more.

We can help you build financial confidence

Business banking

Open a new account and earn up to $1, 000.

Choose a business checking account with optional card payment processing.

Your path to financial confidence starts here

Let's build a Trail Vaults® personalized plan to help you achieve your financial goals.

Plan, track and achieve your goals in one place.

Tap into the collective power of your finances.

-

Easily view your cash flow and track bills & subscriptions to budget better.

-

Grow your money faster with automated savings tools.

-

Manage your rewards and unlock more perks.

-

Login Account

Log in to your account(s) -

24-hour banking

Call VIP Only -

Send and transfer money quickly and safely any time.

We want to help you succeed

We are here to help you, whenever you need it, wherever you are. Be on the go with our mobile app and online services, or reach through any of quick mobile or in-person options for personalized caring service from our team.